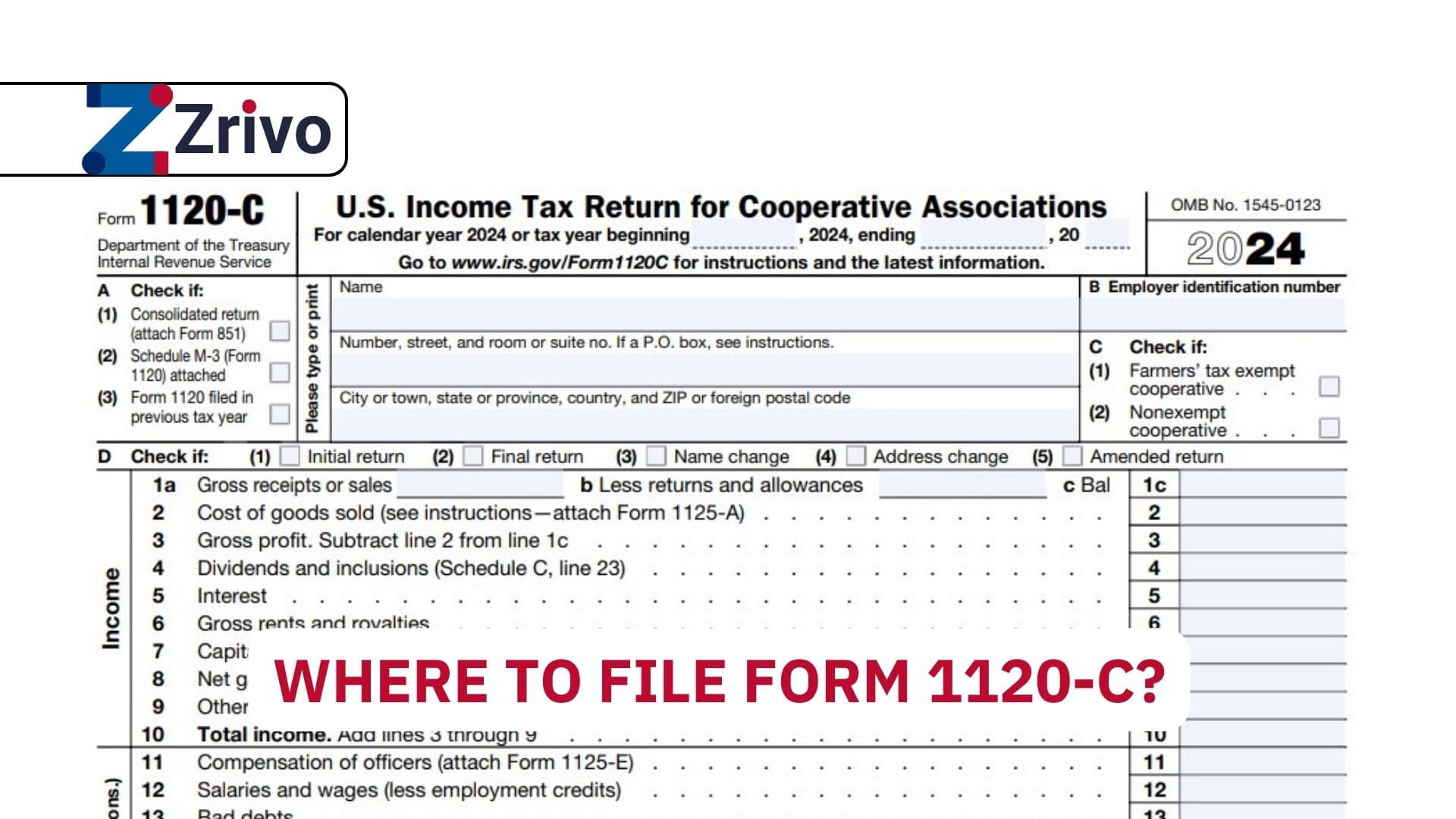

Filing taxes as a cooperative association can be a maze of forms, deadlines, and IRS addresses—but knowing exactly where to file 1120-C is the first step to a smooth tax season. The U.S. Income Tax Return for Cooperative Associations, better known as Form 1120-C, is the primary document that agricultural, utility, and other qualifying cooperatives use to report income, deductions, credits, and tax liability to the IRS. If you’re wondering where to file 1120-C, you’re not alone—this is a common question, especially since IRS mailing addresses can change and depend on your cooperative’s location or whether you’re filing from abroad. In this article, we’ll break down the latest IRS instructions, explain which address to use based on your cooperative’s principal office, and share essential filing tips to help you avoid delays, penalties, or lost paperwork. Whether you’re a seasoned tax pro or a first-time filer, you’ll find everything you need to confidently submit your 1120-C and keep your cooperative in good standing.

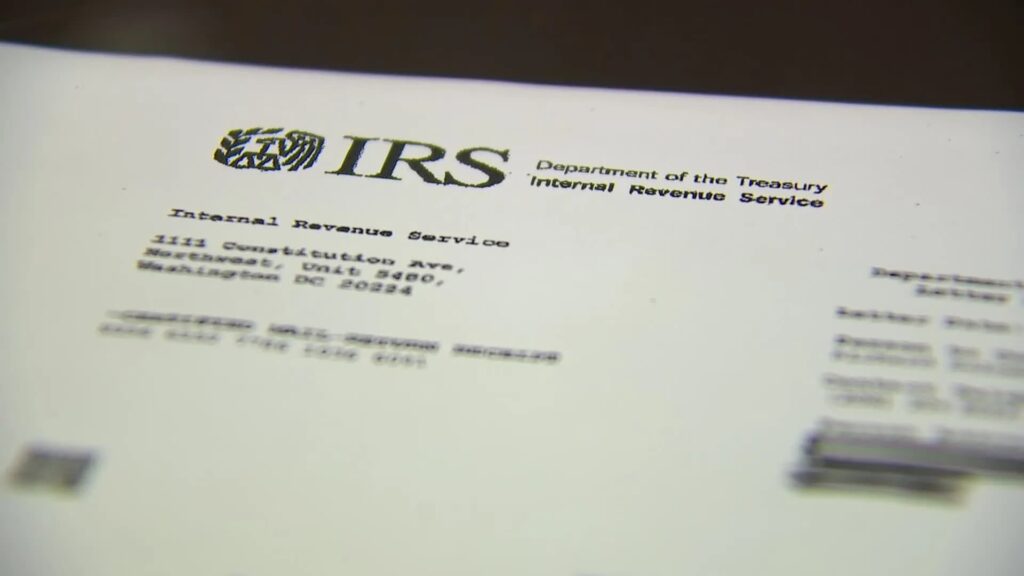

IRS Mailing Addresses for Form 1120-C

The correct filing address for Form 1120-C depends on the location of your cooperative’s principal business, office, or agency. Here’s what you need to know:

1. Cooperatives Located in the United States

If your cooperative’s principal office is in the U.S., mail your completed Form 1120-C to:

Department of the Treasury

Internal Revenue Service

Ogden, UT 84201-0012

2. Cooperatives Located in a Foreign Country or U.S. Territory

If your cooperative’s principal office is outside the U.S. or in a U.S. possession, send your Form 1120-C to:

Internal Revenue Service

P.O. Box 409101

Ogden, UT 84409

Tip: Always use the U.S. Postal Service when mailing to an IRS P.O. box address.

Key Filing Details for Form 1120-C

- Who Must File: Any corporation operating as a cooperative under section 1381, including most agricultural and utility co-ops, must file Form 1120-C.

- What to Report: Use Form 1120-C to report all income, gains, losses, deductions, credits, and to calculate tax liability for your cooperative.

- Important Note: Do not use the address of your registered agent unless it is also your principal business office. The IRS requires the address of your main office or place of business.

- Supporting Statements: Attach all required schedules, statements, and reconciliations as specified in the instructions.

How to Prepare and Mail Your Form 1120-C

- Gather Required Information: Collect your cooperative’s financial statements, prior tax returns, EIN, and supporting documents.

- Complete the Form: Fill out all sections, including income, deductions, and credits. Double-check for accuracy.

- Attach Schedules: Include all necessary schedules, such as Schedule L (balance sheet) and Schedule M-1 (reconciliation of income).

- Mail to the Correct Address: Use the address above based on your cooperative’s principal location.

- Meet the Deadline: Form 1120-C is generally due by the 15th day of the 4th month after the end of your cooperative’s tax year (April 15 for calendar year filers).

E-Filing Options

While you can mail your Form 1120-C, many cooperatives now choose to e-file for speed and convenience. Check with your tax professional or IRS-approved e-file provider to see if your cooperative is eligible for electronic filing.

Common Mistakes to Avoid

- Mailing to the wrong IRS center—double-check the address for your location.

- Forgetting to include all required schedules and statements.

- Using an outdated address from a previous tax year—always verify with the latest IRS instructions.

- Missing the filing deadline, which can result in penalties and interest.

FAQs

Q: Where do I mail Form 1120-C if my cooperative is based in the U.S.?

A: Mail it to Department of the Treasury, Internal Revenue Service, Ogden, UT 84201-0012.

Q: What if my cooperative’s main office is outside the U.S.?

A: Send your Form 1120-C to Internal Revenue Service, P.O. Box 409101, Ogden, UT 84409.

Q: Can I e-file Form 1120-C?

A: Yes, many cooperatives can e-file using IRS-approved providers—check eligibility before filing.

Q: What is the deadline for filing Form 1120-C?

A: The form is due by the 15th day of the 4th month after the end of your cooperative’s tax year.