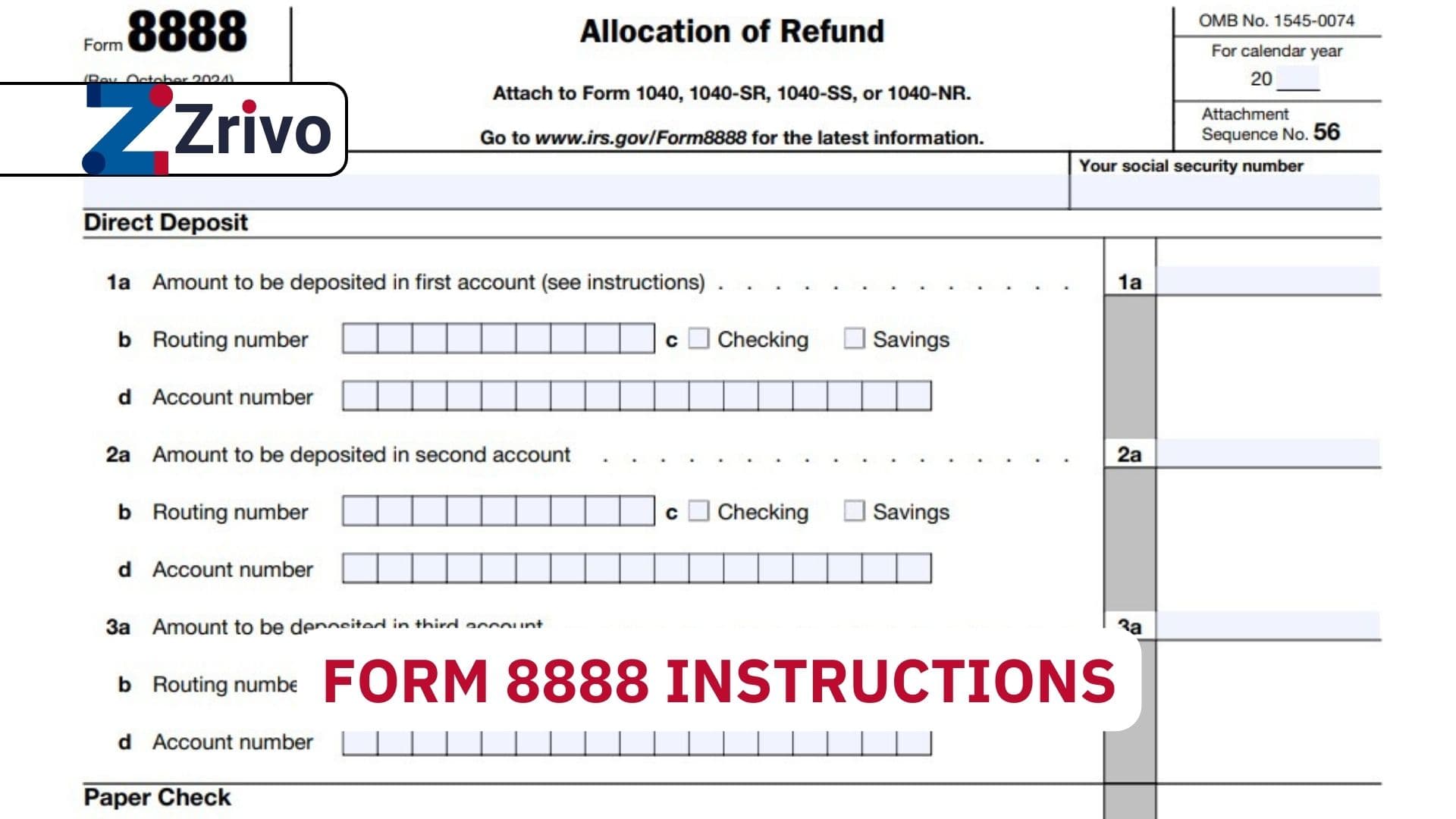

IRS Form 8888, officially titled “Allocation of Refund,” allows taxpayers to split their federal income tax refund into multiple accounts or request part of it as a paper check. This form is particularly useful for individuals who wish to allocate their refund across different financial accounts, such as checking and savings accounts, IRAs, HSAs, or other eligible accounts. Instead of receiving your entire refund in a single deposit or check, Form 8888 lets you divide it between up to three accounts. This flexibility can help with financial planning, such as saving for retirement or covering immediate expenses. However, it’s important to note that the account must be in your name and meet IRS eligibility requirements. Additionally, the program for purchasing savings bonds with refunds has been discontinued, making this form solely focused on refund allocation.

How to File IRS Form 8888

To file IRS Form 8888, follow these steps:

- Attach Form 8888 to Your Tax Return: This form must be submitted alongside your main tax return (Form 1040, 1040-SR, 1040-SS, or 1040-NR).

- Ensure Accuracy: Verify that the routing and account numbers you provide are correct. Errors in this information could lead to delays or rejection of your direct deposit request.

- Meet Eligibility Requirements: Ensure that the accounts listed are eligible for direct deposit under IRS rules and are in your name.

- Submit Electronically or by Mail: Include Form 8888 when filing your tax return electronically or mail it with your paper return.

Form 8888 Line-by-line Instructions

Line 1a: Amount to Be Deposited in First Account

Enter the portion of your refund you wish to deposit into the first account. Each deposit must be at least $1.

Line 1b: Routing Number

Provide the nine-digit routing number for the first account. Ensure the first two digits fall within the ranges specified by the IRS (01–12 or 21–32). Contact your financial institution if you’re unsure about the correct routing number.

Line 1c: Type of Account

Check either “Checking” or “Savings” based on the type of account you’re depositing into. If depositing into specialized accounts like IRAs or HSAs, confirm with your financial institution whether you should select “Checking” or “Savings.”

Line 1d: Account Number

Enter the account number associated with the first deposit. The number can include up to 17 characters but should exclude spaces and special symbols.

Lines 2a–2d and Lines 3a–3d

Repeat the steps above for the second and third accounts if you are splitting your refund across multiple accounts.

Line 4: Amount to Be Refunded by Check

If you want any remaining portion of your refund sent as a paper check, enter that amount here.

Line 5: Total Allocation of Refund

Add together all amounts listed on lines 1a, 2a, 3a, and 4. Ensure this total matches the refund amount shown on your tax return.

Additional Considerations

- Rejected Direct Deposit Requests: If any part of your direct deposit request is rejected (e.g., incorrect account information or exceeding deposit limits), that portion will be refunded via paper check.

- Math Errors or Refund Offsets: If your refund amount changes due to math errors or offsets (e.g., unpaid debts), adjustments will be made starting with deposits listed on line 3 and working backward.

- IRA Contributions: If allocating funds to an IRA, ensure contributions meet deadlines and notify your account trustee about which tax year they apply to.

Why Use Direct Deposit?

Direct deposit offers several benefits:

- Faster refunds compared to paper checks.

- Secure payments that cannot be lost or stolen.

- Cost-effective processing for taxpayers and the government.

- Convenient access without needing a trip to the bank.